how to find ending inventory

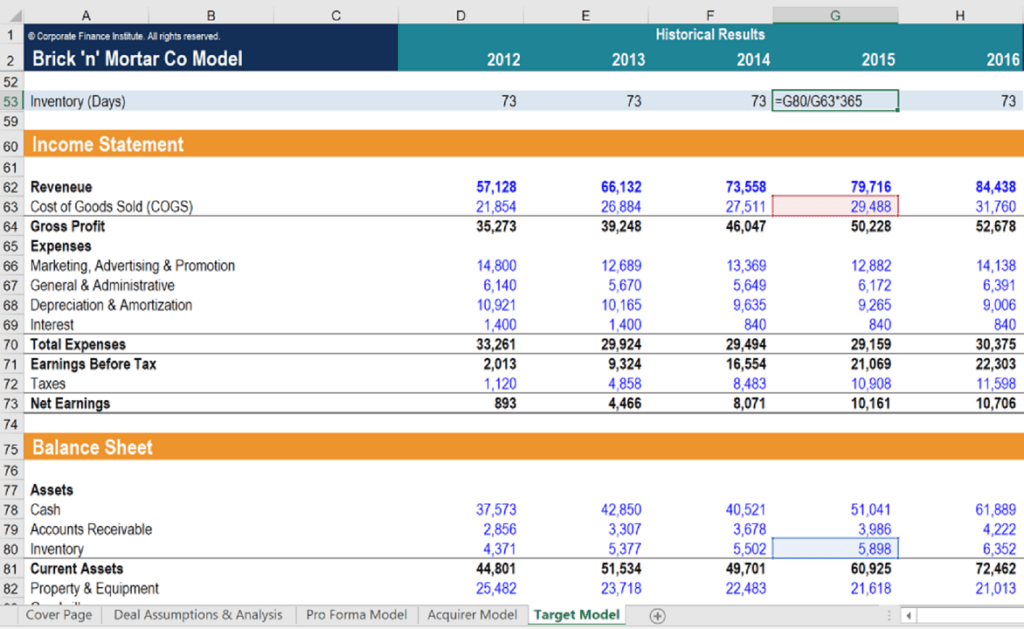

Inventory turnover is calculated as the ratio of cogs to average inventory. Normally the inventory value at the end of an accounting period is reported as an asset on company balance sheets.

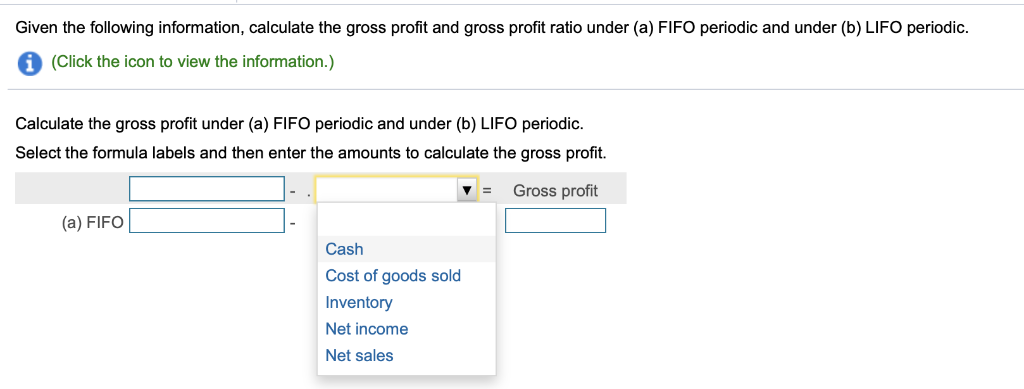

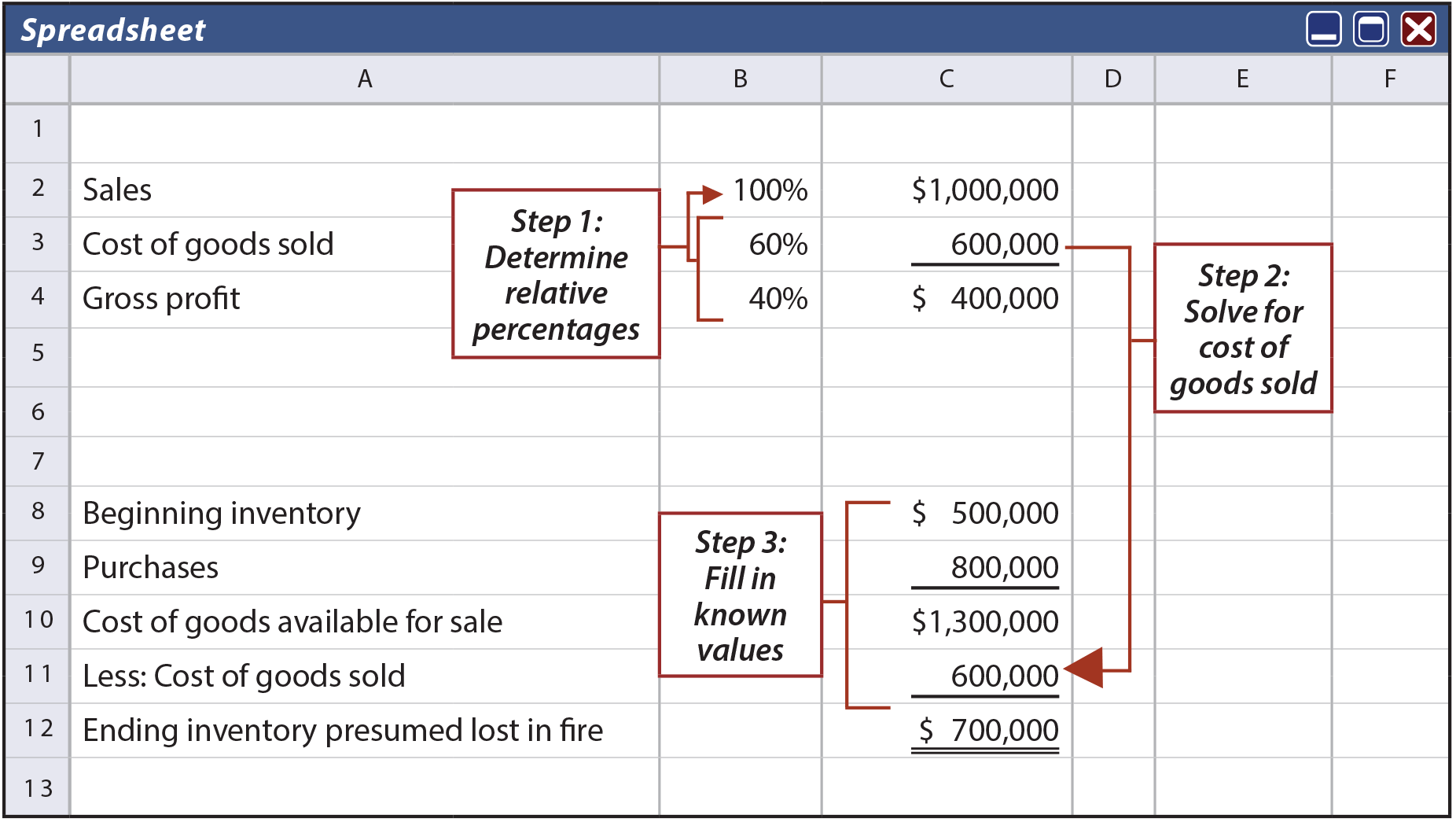

Gross Profit Method To Determine Ending Inventory Also Called

Lifo Periodic Inventory Method Youtube

Inventory Turnover How To Calculate Inventory Turns

But if the companys inventory moves slowly youre more likely to find.

How to find ending inventory on balance sheet.

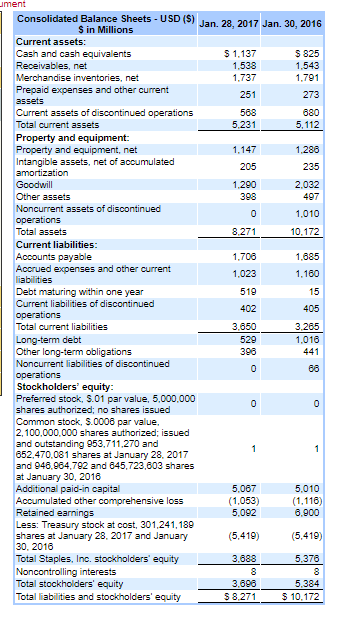

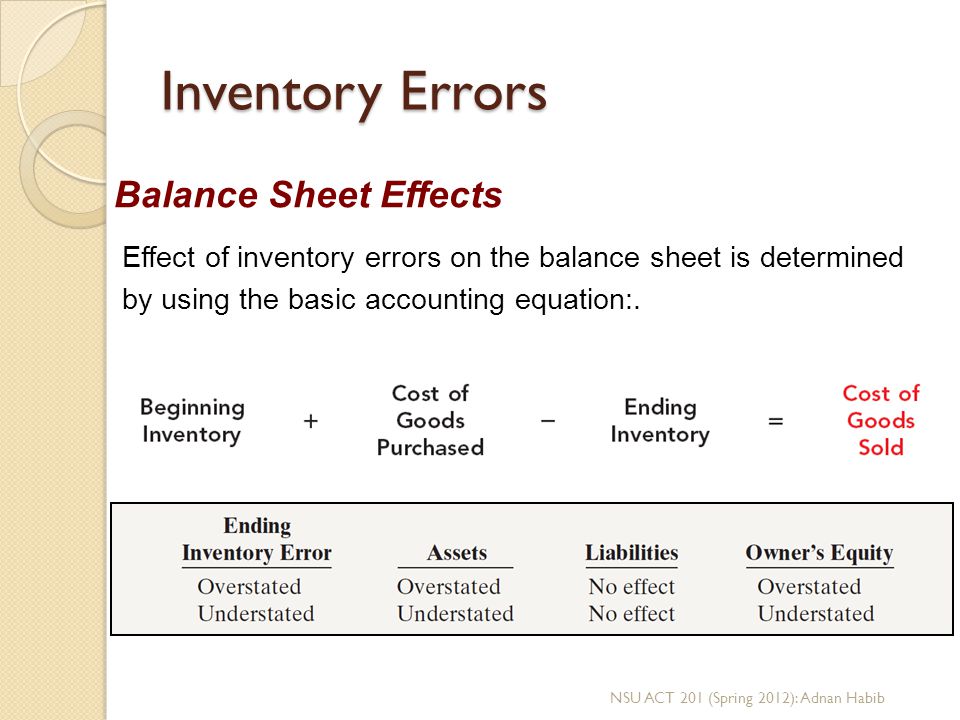

When inventory becomes obsolete a company must reduce its value on the balance sheet by taking a write down on the income statement ie reporting a loss of inventory value.

As long as a company turns over its inventory quickly you probably wont find outdated products sitting on the shelves.

Inventory turnover is especially important for companies that carry physical inventory and indicates how many times inventory balance is sold during the year.

Your balance sheet shows your year end results.

The big question you have for any company when examining financial reports is how quickly it sells its inventory and turns a profit.

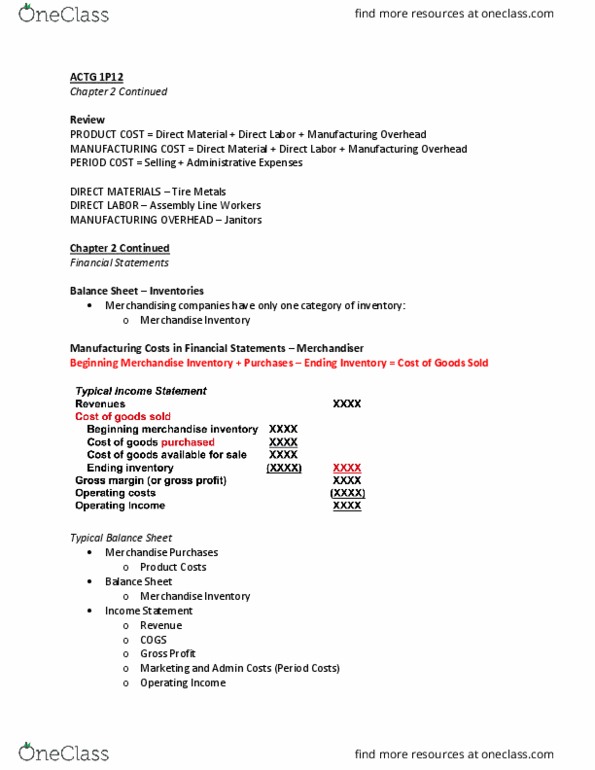

Under last in first out inventory method the last item purchased is the cost of the first item sold which results in the closing inventory reported by the business on its balance sheet depicts the cost of the earliest items purchased.

Sometimes revenues are substituted for cogs and average inventory balance is used.

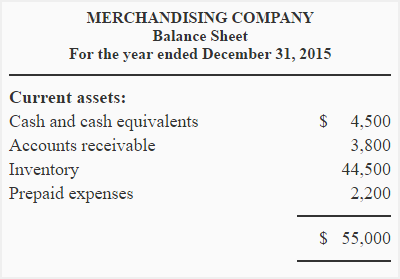

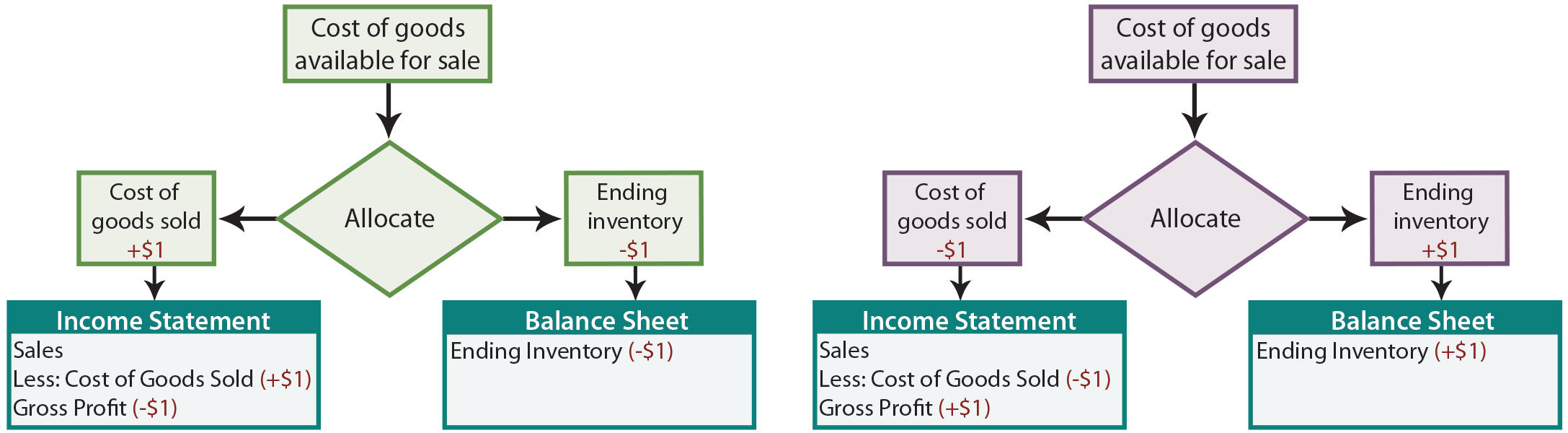

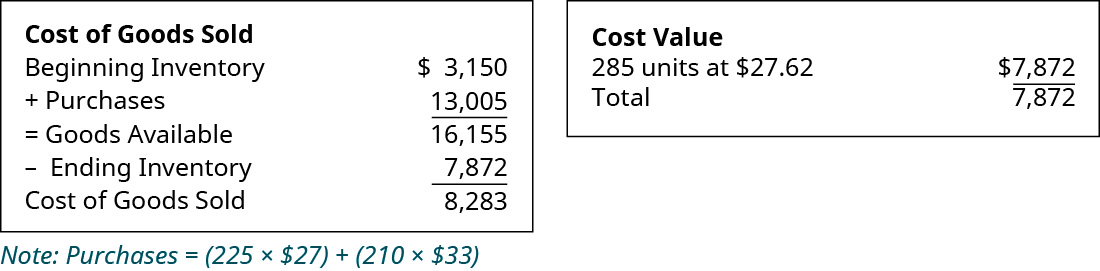

Ending inventory is the total unit quantity of inventory in stock or its total valuation at the end of an accounting period.

The ending inventory figure is needed to derive the cost of goods sold as well as the ending inventory balance to include in a companys balance sheet.

With inventory it is important to remember that your ending inventory at your years end is your beginning inventory for the next year.

It is an asset because it is something your small business will derive economic value from in the future.

Ending inventory is valued on the balance sheet using the earlier costs and in an inflationary environment lifo ending inventory is less than the current cost.

One of the items on both sides of the equation is your inventory which comes into and leaves your business depending on sales for the period.

If a company habitually writes down large amounts of inventory it may be due to the fact that management is unable to align product and procurement with a reasonable expectation of demand.

Inventory is a balance sheet account and it is an asset.

To find out how much profit or loss your business has produced in the last accounting period you need to prepare a balance sheet which shows the flow of money into and out of your business.

Beginning and ending inventory are not always listed on income statements but both values are necessary to calculate cost of goods sold to charge against gross sales.

Solved Restate The Income Statement To Reflect Lcm Valuat

Sap Inventory Valuation Through Fifo Sap Blogs

Types Classification Of Inventory Accounting For Management

Actg 1p12 Lecture 3 Lecture 3 01 15 18 Oneclass

Solved Determine The Net Purchases Of Your Company Show

Production Budget Calculator For A Business Plan Plan Projections

Ending Inventory Balance Sheet

Details Of The Fifo Lifo Inventory Valuation Methods

Prepare Ending Balance Sheet On December 31 2019 A Fire

Inventories And Cost Of Goods Sold Ppt Download

Solved In Each Case Indicate The Correct Amount To Be Re

Chapter 6 Inventories Ppt Video Online Download

Inventory Costing Methods Principlesofaccounting Com

What Is Beginning Inventory Beginning Inventory Formula

Inventory Estimation Techniques Principlesofaccounting Com

Calculate The Cost Of Goods Sold And Ending Inventory Using The

How To Calculate Return On Assets Roa With Examples

1 Chapter 8 Inventory Valuation 2 The Inventory Formula Used To

how to find ending inventory

Source: https://goodttorials.blogspot.com/2019/11/how-to-find-ending-inventory-on-balance.html

Posted by: spauldingablemplaid.blogspot.com

0 Response to "how to find ending inventory"

Post a Comment